malaysian income tax relief 2018

The amount of tax relief 2018 is determined according to governments graduated scale. Essentially for YA 2018 the tax relief for medical expenses for serious diseases as well as complete medical examination has been combined though the maximum relief for.

Deferred Tax Asset Journal Entry How To Recognize

My estimated tax relief for YA 2018 is RM2146085 RM1836085.

. This additional relief is available for purchases made between 1 June 2020 and 31 December 2022 provided that the total amount claimed under the special tax relief has not been claimed. SME It is proposed that the income tax rate on first RM500000 of chargeable income of SME be reduced from 18 to 17. Granted automatically to an individual for.

The incentives include the following. Corporate tax rates for companies resident in Malaysia is 24. KUALA LUMPUR April 9 Malaysias personal income tax system is progressive with the aim of continuously assisting low-income earners.

Monday 09 Apr 2018 235 PM MYT. 1 Individual and dependent relatives. 1 A medical policy must satisfy the following criteria a the.

If planned properly you can save a. However any amount that is withdrawn after your first. Tax relief refers to a reduction in the amount of tax an individual or company has to pay.

This would enable you to drop down a tax bracket lower. Here are the full details of all the tax reliefs that you can claim for YA 2021. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share capital of.

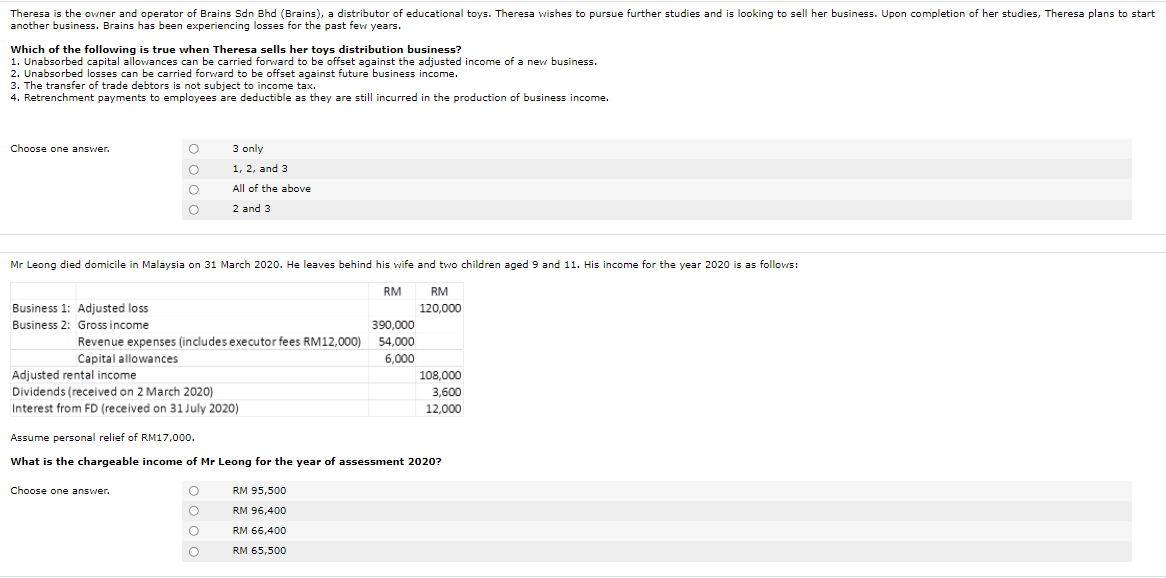

This program provides a maximum 12-month income tax exemption for women aged between 30 and 50 years old. 15 Tax incentives 16 Exchange controls 20 Setting up a business 21 Principal forms of business entity 22 Regulation of business 23 Accounting filing and auditing requirements 30. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500.

Net saving in SSPNs scheme total deposit in year 2018 MINUS total withdrawal in year 2018 RM6000 limited Another tax relief that will benefit families out there. To qualify for this income tax relief the Malaysian insurance policy must be in your name the policy owner is the claimant. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying.

Malaysia Personal Income Tax Rate A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up. In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable Income Bands 20001-35000 35001 50000 50001 -70000 will now be taxed.

March 10 2022 For income tax in Malaysia personal deductions and reliefs can help reduce your chargeable income and thus your taxes. So the estimated total amount of my personal tax relief for YA 2018 is RM2146085 RM1836085. If you have deposited money into your SSPN account in 2018 then this amount can be claimed in your e-BE form as well.

IRBM has issued Public Ruling PR No42018 dated 13 September 2018 in relation to the personal reliefs under the title of Taxation of a Resident Individual Part 1- Gifts. A resident company incorporated in Malaysia.

Country Reports On Terrorism 2018 United States Department Of State

My Personal Tax Relief For Ya 2018 The Money Magnet

Reliefs For Personal Income Tax 2017 Vs 2016 Teh Partners

Finance Malaysia Blogspot Ya2017 Tax Relief For Personal Income Tax Filing

Here S 5 Common Tax Filing Mistakes Made By Asklegal My

How To Read And Understand Your Form W 2 At Tax Time

Rate 0 1 3 8 Individual Income Tax Rates Ya 2018 To Chegg Com

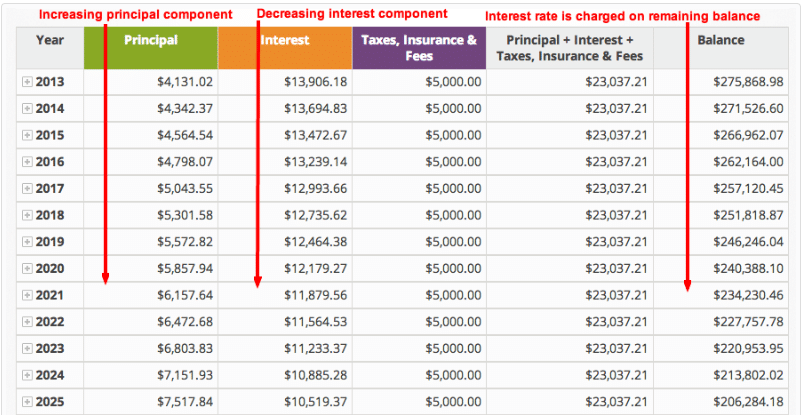

How To Calculate Amortization Expense For Tax Deductions

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Malaysian Tax Issues For Expats Activpayroll

Expanded Meals And Entertainment Expense Rules Allow For Increased Deductions Our Insights Plante Moran

France Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Individual Income Taxes Urban Institute

Effects Of Income Tax Changes On Economic Growth

How Does The Current System Of International Taxation Work Tax Policy Center

0 Response to "malaysian income tax relief 2018"

Post a Comment